What are Budgeting Apps, and How Can They Help You?

With the rise of technology, budgeting apps have become a great way to keep track of your finances. These apps provide a convenient and easy way to manage your money on the go. They do this by helping you create budgets, track spending, and save for future goals. With budgeting apps, you can ensure that you stay within your means and that your financial future is secure. So if you want better control over your finances, then budgeting apps may be just what you need!

Top 4 Benefits of Using Budgeting Apps

With the ever-increasing cost of living, staying on top of your finances is becoming harder and harder. Budgeting apps can be a great option if you’re looking for ways to save money and improve your financial health. There are lots of great budget apps out there that can help you manage your money better and make smarter decisions about where to spend it. In this article, we’ll look at the top 4 benefits of using budgeting apps so you can decide if they’re right for you.

Put away your spreadsheets!

To make a budget, you must first keep tabs on your monthly income and the expenses you must pay.

A budgeting tool can help you save time and effort by analyzing your spending habits and providing insights into where you can make immediate cuts.

Some of the more advanced budgeting apps on the market may even automatically evaluate the price of utility tariffs in your area and assist you in switching suppliers to save money on your household bills, which can be done by analyzing your regular payments to identify any unneeded subscriptions.

Budgeting that is easy on the user

Budgeting applications, like any other useful program or software, must be straightforward to use to gain widespread adoption.

There is more to it than superficial appeal. The categories in which you put your hard-earned cash should be made obvious by a decent personal finance app.

Instant alerts when you need to know anything could be a major perk of having it on your phone. Overspending can be avoided, for instance, by receiving a warning when you are about to hit your monthly spending limit through buzz or ping.

Make Saving Money Fun

Managing your finances doesn’t have to be a drag. Budgeting can be an engaging and fun activity with the help of budgeting apps that use features usually found in video games! These features can include assigning regular activities for you, displaying colorful bars to help track progress towards your savings or debt repayment goals, and even giving you cash rewards for meeting those goals. So don’t think of your budget as a boring list of dos and don’ts – with the right mindset and tools, you can make following your budget an exciting challenge.

Real-time budgeting

It’s no secret that we have spending urges that we sometimes can’t resist. A key part of budgeting is learning to say no to those impulse buys. That’s where having good budget visibility can come in handy.

For example, some apps can help you budget by giving you a real-time view of your spending across all your debit and credit cards. These apps consider any recurring bills you have to get an adjusted balance before your next payday.

This is an easy way to track and adjust your spending at a glance, which can help you stick to your budget in the long run.

Comparing the 6 Best Free Budgeting Apps

keywords: budget planning software comparison, best personal finance apps 2021, top budget apps for android and ios)

Mint

Pros: We recommend Mint for various reasons – starting with the app’s high ratings in both the App Store and Google Play. (It also has more reviews than any other app we reviewed.) Not to mention, it’s free and syncs many kinds of accounts: checking and savings, credit cards, loans, investments, and bills.

As for budgeting, Mint tracks your expenses and places them in budget categories. You can personalize these unlimited categories. You set limits for these categories, and Mint notifies you if you’re nearing those limits.

Mint is more than just a budgeting app – it can also help users pay down debt, save money and track goals. The app provides “Mintsights” to users, as well as a credit score and net worth. Plus, Mint comes with tons of support, including a detailed FAQ.

Cons: Mint is an impressive app because it tracks everything on your behalf. However, other apps on our list may work better for you if you want to be more actively involved in your budgeting.

YNAB

Pros: YNAB is designed to help users plan for their financial future rather than track their past transactions. YNAB follows a zero-based budgeting system, which lets you plan for every dollar you earn.

As soon as you get paid, YNAB will prompt you to actively decide how much of your income should go toward various categories, including expenses, goals, and savings. The idea is that you can better manage your finances by being more intentional with your money.

YNAB is a very hands-on budgeting app, which can be difficult for users new to budgeting. YNAB’s website offers many educational resources to help users budget and use the app.

YNAB allows you to link your checking and savings accounts, credit cards, and loans. The app works on phones, desktops, iPad, Apple Watch, and Alexa.

Cons: YNAB is an excellent tool for those wanting to be more hands-on with money management. However, it does require a certain level of commitment from users. Additionally, after 34 days of trial, you should pay $14.99 per month or $99 per year.

Personal Capital

Pros: Personal Capital is a great option if you’re looking for a budgeting tool that can also help you track your investments.

The app is free to use and allows you to connect and monitor your financial accounts, including checking and savings accounts, credit cards, IRAs, 401(k)s, mortgages, and loans.

You can also see a spending snapshot by category, which can be customized to your needs. This is a great way to see where your money goes each month and make necessary adjustments to your budget.

Personal Capital’s net worth and portfolio tracker can be accessed on your phone and computer, making it convenient to check in on your progress no matter where you are.

Cons: If you’re looking for an app to help you plan your spending and saving, this one may be for you.

This app’s budgeting features are robust, but its investment tools make it unique. Other apps have more detailed budgeting capabilities, but this one may be better if you want investment help.

Honeydue

Pros: Honeydue is a free budgeting app that allows you and your partner to view your financial pictures in one place.

You can sync bank accounts, credit cards, loans, and investments and choose how much you share with your partner.

The app also automatically categorizes expenses and lets you set monthly limits on each category. Plus, it sends reminders for upcoming bills, lets you chat, and sends emojis.

Cons: Unlike some other apps on our list, Honeydue is more focused on reflecting and learning from past transactions than planning for expenses.

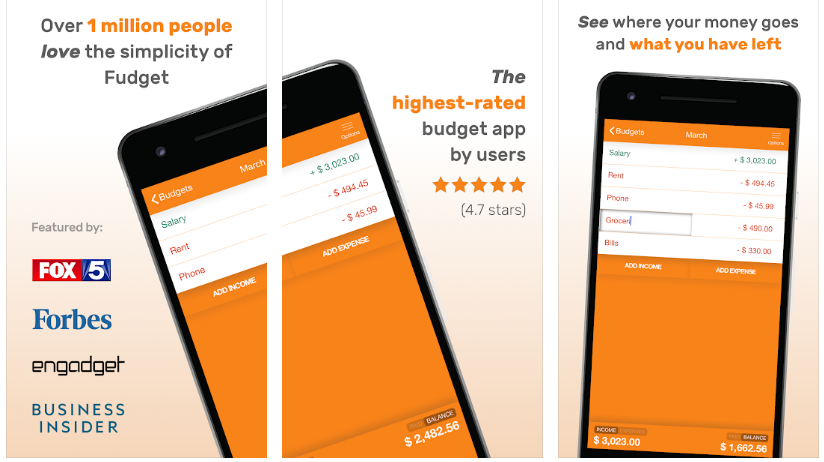

Fudget

Pros: Fudget is the perfect app for those who would rather not sync their financial accounts and prefer a straightforward calculator-Esque interface over fancy features.

With Fudget, you can make lists of incoming and outgoing money and track your balances without hassle. The Pro account allows you to export your budget and enjoy other extras!

Cons: This app might not be for you if you want more than the basics, like categorizing expenses or getting insights. And if you’re not logging every expense, other apps would suit you better.

We didn’t find many user guides, either.

Splitwise

Pros: If you’re looking for a way to manage your finances, the Splitwise app is worth considering. With Splitwise, you can easily keep track of your expenses and income, so you can always know where you stand financially. The app also makes splitting bills with friends or roommates easy, so you can avoid arguments about who owes what. Overall, the Splitwise app is a great tool for anyone who wants to take better control of their finances.

Cons: If you like apps with only a few functions to perform, you should not use splits because it has a wide range of capabilities that might be overwhelming for beginning users.

In addition, Splitwise does not accept cash transactions; therefore, you cannot link it to a bank account even if you want to. Only purchases and outstanding IOUs are recorded in Splitwise’s database.

Picking the Right Budget App For Your Needs

Many budget apps are out there, so how do you know which is right for you? The first step is to figure out what your budgeting needs are. Do you need something simple to track your spending? Or do you need something more sophisticated to help you plan and stick to a budget?

Once you know what you need, you can look at different budget apps and see which ones offer the features you’re looking for. Some apps are free, while others have a monthly or yearly subscription fee. Make sure to compare the app’s cost with its value.

Finally, take some time to read reviews of different budget apps before deciding. This can help you better understand which are popular and which might have drawbacks.

With so many budget apps, finding the right one for your needs can save you a lot of time and money in the long run.

Start Using a Budget App Today to Get Your Finances in Shape and Achieve Your Goals

If you are like most people, you are living paycheck to paycheck and barely have any extra money to put away. We know it can be a struggle to get your finances in order, but it’s time to make a change—and there’s no time like the present. We hope this blog post helped you learn more about budget apps and how they can help you manage your finances.